Step-by-Step Process to Look For Conventional Mortgage Loans

Step-by-Step Process to Look For Conventional Mortgage Loans

Blog Article

Comprehending the Numerous Sorts Of Home Mortgage Finances Available for First-Time Homebuyers and Their One-of-a-kind Benefits

Browsing the array of mortgage alternatives available to newbie homebuyers is vital for making enlightened financial decisions. Each sort of lending, from traditional to FHA, VA, and USDA, offers distinct benefits customized to diverse buyer demands and circumstances. In addition, special programs exist to improve price and provide important sources for those getting in the real estate market for the first time. Comprehending these differences can significantly affect your home-buying trip, yet lots of continue to be unaware of the finer details that might influence their selections. When examining these alternatives?, what crucial factors should you consider.

Traditional Fundings

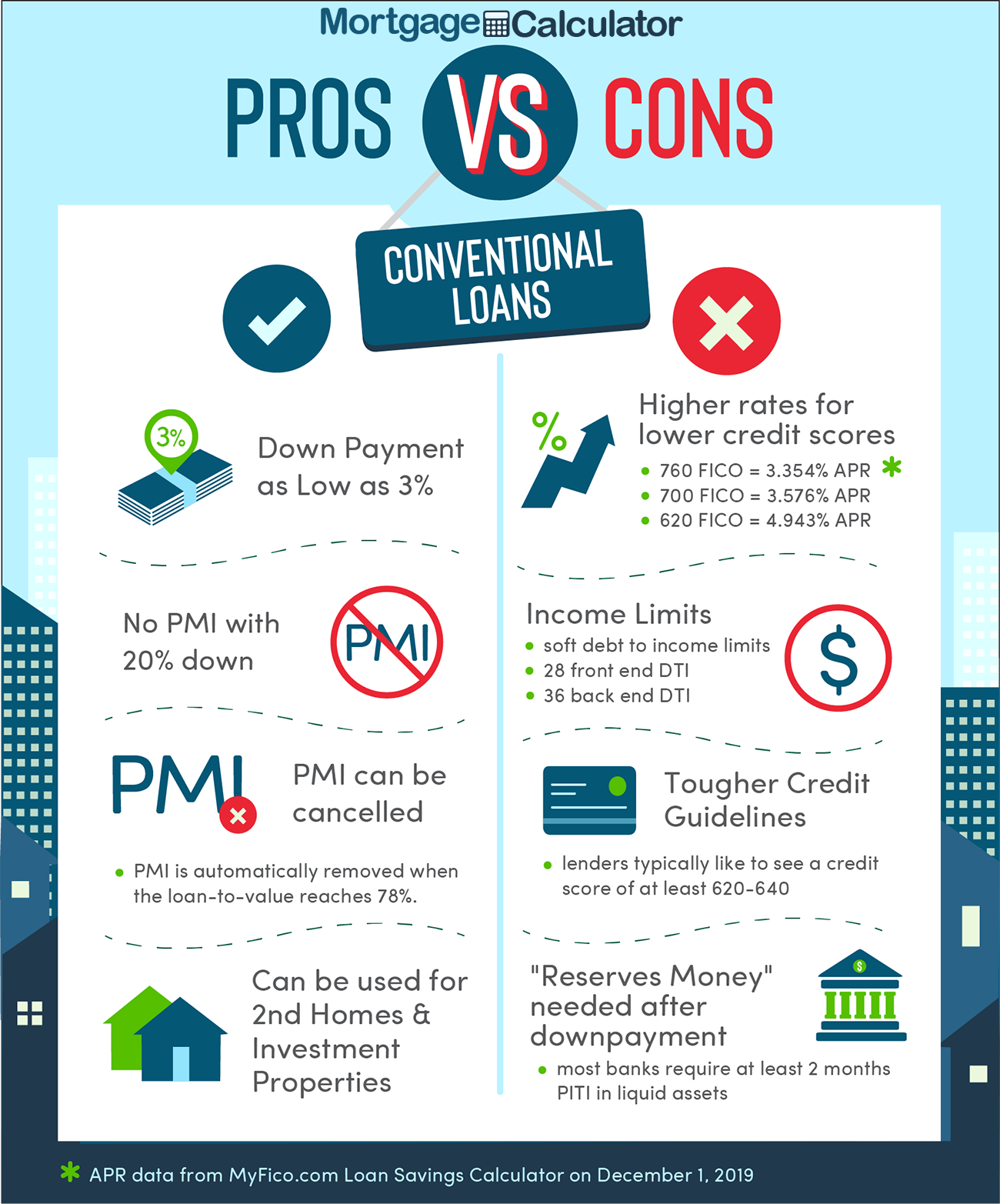

Conventional lendings are a cornerstone of home loan funding for novice buyers, offering a reputable alternative for those wanting to acquire a home. These car loans are not guaranteed or ensured by the federal government, which identifies them from government-backed car loans. Commonly, traditional financings require a higher credit rating rating and an extra substantial deposit, commonly ranging from 3% to 20% of the acquisition rate, depending on the loan provider's needs.

Among the significant advantages of traditional financings is their flexibility. Consumers can select from different financing terms-- most commonly 15 or 30 years-- enabling them to align their home mortgage with their economic objectives. Additionally, conventional financings might offer lower rate of interest compared to FHA or VA car loans, particularly for debtors with solid credit history profiles.

Another benefit is the lack of upfront mortgage insurance policy premiums, which are typical with government fundings. Personal mortgage insurance (PMI) might be needed if the down repayment is less than 20%, yet it can be eliminated once the borrower attains 20% equity in the home. In general, conventional car loans present a sensible and eye-catching financing choice for novice homebuyers looking for to browse the home loan landscape.

FHA Finances

For many new property buyers, FHA lendings stand for an easily accessible pathway to homeownership. Guaranteed by the Federal Housing Management, these fundings provide versatile qualification standards, making them perfect for those with minimal credit report or reduced income degrees. Among the standout features of FHA finances is their low down settlement requirement, which can be as low as 3.5% of the acquisition price. This substantially reduces the monetary obstacle to entry for many hopeful homeowners.

Additionally, FHA loans permit for higher debt-to-income ratios compared to traditional loans, fitting consumers that might have existing financial obligations. The rate of interest rates connected with FHA financings are frequently competitive, further boosting affordability. Customers also benefit from the capability to include specific closing expenses in the financing, which can reduce the ahead of time financial burden.

Nevertheless, it is very important to keep in mind that FHA finances call for home loan insurance policy costs, which can boost regular monthly repayments. In spite of this, the overall benefits of FHA fundings, including ease of access and lower first prices, make them an engaging choice for first-time homebuyers looking for to go into the actual estate market. Recognizing these financings is crucial in making educated choices regarding home financing.

VA Loans

VA loans supply a special financing solution for qualified experts, active-duty solution members, and particular participants of the National Guard and Reserves. These loans, backed by the united state Department of Veterans Matters, supply several advantages that make home possession more obtainable for those that have offered the nation

Among the most substantial benefits of VA loans is the lack of a down payment need, allowing qualified consumers to finance 100% of their home's acquisition cost. This attribute is especially advantageous for newbie buyers who might battle to save for a considerable down settlement. Additionally, VA fundings commonly come with competitive rates of interest, which can bring about lower month-to-month repayments over the life of the financing.

One more remarkable benefit is the lack of personal home loan insurance coverage (PMI), which is commonly needed on standard fundings with low deposits. This exemption can result in considerable financial savings, making homeownership more budget-friendly. VA fundings offer flexible credit report requirements, allowing debtors with lower credit score ratings to certify even more easily.

USDA Lendings

Exploring financing options, new buyers might locate USDA finances to be an engaging option, specifically for those aiming to acquire property in country or country areas. The USA Division of Agriculture (USDA) offers these lendings to advertise homeownership in designated rural regions, providing an excellent possibility for qualified purchasers.

Among the standout attributes of USDA fundings is that they need no deposit, making it easier for new purchasers to enter the real estate market. Furthermore, these lendings typically have affordable rates of interest, which can cause lower month-to-month settlements contrasted to conventional funding pop over to this web-site options.

USDA financings likewise feature versatile credit report requirements, making it possible for those with less-than-perfect credit history to certify. The program's earnings restrictions guarantee that aid is guided in the direction of low to moderate-income households, further supporting homeownership objectives in rural neighborhoods.

In addition, USDA fundings are backed by the federal government, which lowers the threat for loan providers and can simplify the approval process for debtors (Conventional mortgage loans). Therefore, novice buyers considering a USDA finance may find it to be a helpful and accessible alternative for achieving their homeownership dreams

Special Programs for First-Time Purchasers

Several new homebuyers can gain from special programs made to aid them in navigating the complexities of buying their very first home. These programs explanation usually provide financial incentives, education, and resources tailored to the special demands of amateur buyers.

In Addition, the HomeReady and Home Feasible programs by Fannie Mae and Freddie Mac deal with reduced to moderate-income purchasers, offering adaptable home loan options with reduced home mortgage insurance prices.

Educational workshops hosted by various companies can likewise help first-time purchasers recognize the home-buying process, improving their opportunities of success. These programs not only ease financial worries however additionally equip customers with understanding, ultimately assisting in a smoother change right into homeownership. By discovering these special programs, new property buyers can uncover important sources that make the imagine possessing a home more attainable.

Conclusion

Traditional finances are a foundation of home loan financing for new buyers, supplying a reputable option for those looking to purchase a home. These loans are go to this site not guaranteed or ensured by the federal government, which differentiates them from government-backed lendings. Additionally, standard fundings may offer reduced passion rates compared to FHA or VA financings, particularly for customers with solid credit accounts.

Additionally, FHA loans enable for higher debt-to-income proportions compared to standard finances, suiting consumers that might have existing monetary obligations. Furthermore, VA lendings commonly come with competitive passion rates, which can lead to decrease monthly repayments over the life of the lending.

Report this page